OECD: Climate finance from developed to developing countries totalled USD 79.6 bn in 2019

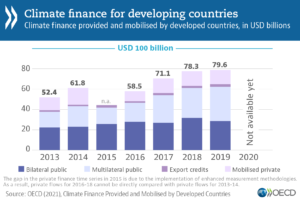

PARIS, France, 17 September 2021: Climate finance provided and mobilised by developed countries for developing countries totalled USD 79.6 billion in 2019, up two per cent from 78.3 billion in 2018, according to new figures from the OECD.

The small increase was driven by a rise in public climate finance provided by multilateral institutions, while bilateral public climate finance commitments dropped, as did climate finance mobilised from private sources, OECD said through a Press release, issued for the purpose of sharing the new figures.

‘Climate Finance Provided and Mobilised by Developed Countries: Aggregate trends updated with 2019 data’ is the OECD’s fourth assessment of progress towards the UNFCCC goal of mobilising USD 100 billion per year by 2020 to help developing countries tackle and adapt to climate change.

“Climate finance continued to grow in 2019, but developed countries remain USD 20 billion short of meeting the 2020 goal of mobilising USD 100 billion,” Mathias Cormann, OECD Secretary-General, said. “The limited progress in overall climate finance volumes between 2018 and 2019 is disappointing, particularly ahead of COP26. While appropriately verified data for 2020 will not be available until early next year, it is clear that that climate finance will remain well short of its target. More needs to be done. We know that donor countries recognise this, with Canada and Germany now taking forward a delivery plan for mobilising the additional finance required to reach the USD 100bn a year goal.”

The report finds that public climate finance from developed countries reached USD 62.9 billion in 2019. Bilateral public climate finance accounted for USD 28.8 billion, down 10% from 2018, and multilateral public climate finance attributed to developed countries accounted for USD 34.1 billion, up by 15% from 2018, the report revealed. The level of private climate finance mobilised was down four per cent at USD 14.0 billion in 2019, after USD 14.6 billion in 2018. Climate-related export credits remained small at USD 2.6 billion, accounting for just three per cent of total climate finance, the report said.

The report also shows that out of the overall climate finance in 2019, 25% went to adaptation (up from 21% in 2018), 64% went to climate change mitigation activities (down from 70% in 2019), and the remainder to cross-cutting activities. More than half of total climate finance targeted economic infrastructure – mostly energy and transport – with most of the remainder going to agriculture and social infrastructure, notably water and sanitation, the report said.

Asia has been the main beneficiary of climate finance over 2016-19, with 43% of the total, on average, followed by Africa (26%) and the Americas (17%), the report said. Climate finance for Least Developed Countries rose strongly in 2019 (up 27% on 2018), but funding for Small Island Developing States fell back to 2017 levels (from USD 2.1 billion to 1.5 billion) after a temporary increase in 2018, the report pointed out.

The data confirm that SIDS face specific challenges in accessing climate finance. The international community needs to consider financing for climate that is appropriate for the challenges that SIDS face, less fragmented, easier to access, predictable and long-term, the report said.

Cormann said: “It is more urgent than ever that developed countries step up their efforts to deliver finance for climate action in developing countries, particularly to support poor and vulnerable countries to build resilience against the growing impacts of climate change.”

In terms of public finance instruments, public grant financing jumped by 30% from 2018 to reach USD 16.7 billion in 2019, after having remained stable the three previous years. In contrast, the volume of public loans, which had increased significantly up to 2018, fell by five per cent in 2019. As a result, the share of grants in overall public climate finance was 27% in 2019, while loans (both concessional and non-concessional) represented 71%.